What Xponential Fitness, Inc.’s (NYSE:XPOF) 26% Profit Is Not Telling You

Shares of Xponential Fitness, Inc. (NYSE:XPOF) shareholders will be happy to see that the stock price had a good month, posting a 26% gain and recovering from earlier weakness. In retrospect, an 11% increase over the past twelve months isn’t too bad regardless of the strength over the past 30 days.

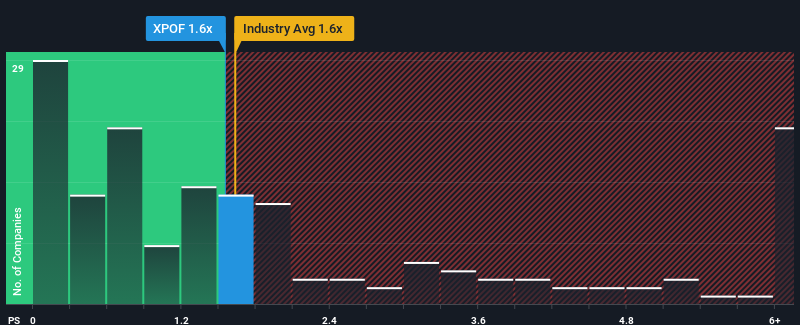

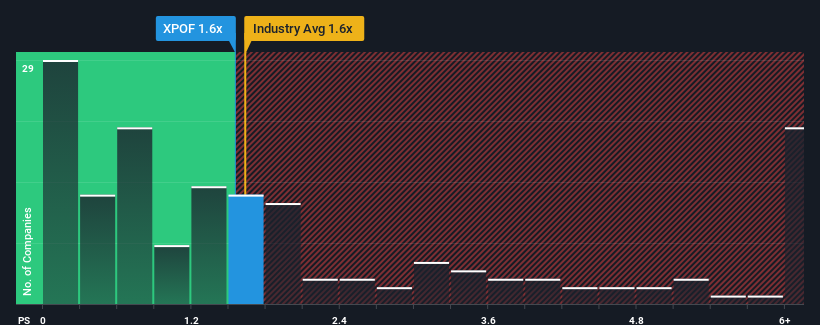

Despite the sharp drop in price, there are still not many who think that Xponential Fitness’ price-to-sale (or “P/S”) of 1.6x is worth mentioning. and medium P/. S in the United States’ Hospitality sector. However, it is unwise to simply ignore the P/S without explanation as investors may be overlooking a unique opportunity or a costly mistake.

Check out our latest review for Xponential Fitness

How Recent Is Xponential Fitness?

Xponential Fitness may be doing better as it has been growing revenue less than other companies lately. Perhaps the market expects that future earnings will rise, which has kept the P/S low. However, if this is not the case, investors may be caught paying too much for the stock.

Curious about how analysts think the future of Xponential Fitness will shape the industry? In that case, we for free A report is a good place to start.

Are Earnings Ratios Similar to P/S Ratios?

There is a natural logic that a company should match the industry for P/S ratios like Xponential Fitness’ to be considered reasonable.

After all, last year brought a good 9.0% increase in the company’s earnings. Interestingly, revenue is also up 145% overall from three years ago, thanks in part to the last 12 months of growth. Therefore, it is fair to say that recent revenue growth has been very positive for the company.

Looking ahead now, earnings are expected to rise 7.8% annually over the next three years according to the ten analysts that follow the company. Meanwhile, another industry is expected to grow by 12% every year, which is even more impressive.

Because of this, it’s surprising that Xponential Fitness’ P/S stays in line with most other companies. It is clear that many investors in the company are less bearish than analysts indicate and are not willing to let go of their stock now. These shareholders may be setting themselves up for future disappointment if the P/S falls in line with growth expectations.

The Last Word

Xponential Fitness’ stock has had a big run lately, which has brought its P/S level up with the rest of the industry. Although the price-to-sales ratio should not be the determining factor in whether you buy a stock or not, it is a great measure of income expectations.

Given that Xponential Fitness’s earnings growth estimates are relatively subdued compared to the broader industry, it’s surprising to see it trading at its current P/S ratio. When we see companies with earnings expectations that are relatively weak compared to the industry, we suspect that the share price is at risk of falling, reducing the modest P/S. This puts shareholders’ investments at risk and potential investors are at risk of paying unnecessary fees.

Because I said that, watch out Xponential Fitness shows 3 warning signs in our investment analysis, and 1 of them is somewhat unpleasant.

Of course, profitable companies with a history of strong earnings growth are usually safe bets. So you might want to see this for free a collection of other companies with reasonable P/E ratios and strong earnings growth.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are price sensitive or quality materials. Simply Wall St has no position in the stocks mentioned.

#Xponential #Fitness #Inc.s #NYSEXPOF #Profit #Telling